Sometimes parents can be busy throughout the school year and the last thing that they want to do is have to worry about paying for their child’s tuition and making their payment on time. To make it easier, here are some helpful tips that your school can do to help out families pay for tuition.

Use Student Profiles

As a parent of a student, you know that it can be difficult to make sure your child has the resources they need to succeed in school. From textbooks to computers to school supplies, the cost of educational materials can add up quickly. To help alleviate this financial burden, many schools are now offering student profile payment options that allow parents to pay for specific student materials.

Student profile payment options are a great way for parents to pay for individual student materials. These options can be set up to cover things like textbooks, sports equipment, musical instruments, and other school supplies. Instead of making a lump sum payment for all items, parents can pay for each item separately, allowing them to budget more effectively.

When setting up a student profile payment option, parents will need to provide information about their child’s school, grade level, and the items they would like to purchase. This information is then used to generate a personalized payment plan. Parents can then choose to pay for the items in full or in installments. Depending on the school, parents may also have the option to pay for items using a credit card.

If you are a parent of a student, then you should definitely consider setting up a student profile payment option. Not only will it help you manage your finances more effectively, but it will also help ensure that your child has all the resources they need to succeed in school.

Find The Right Payment System

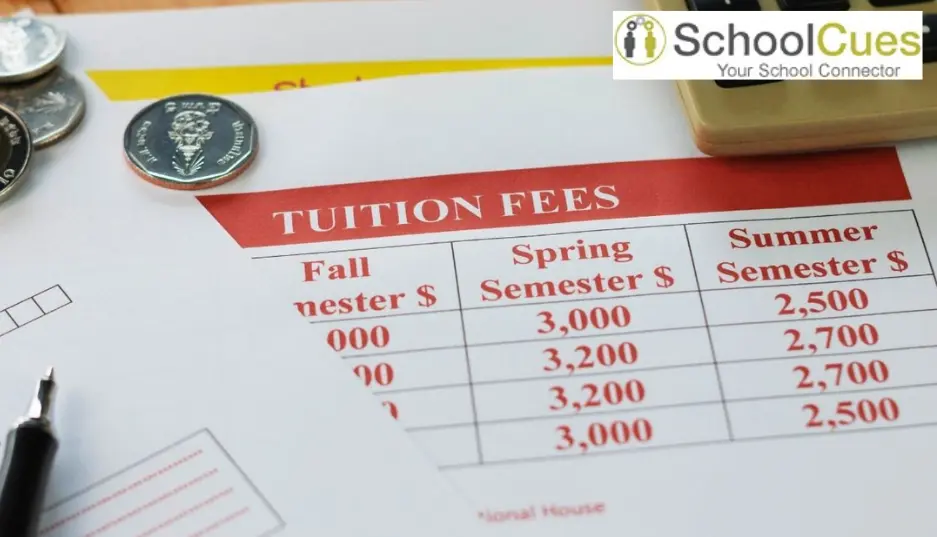

When it comes to tuition payment systems for small schools, there are several options available. These include paying once a year, once a semester, or once a month. Each of these payment systems has its own advantages and disadvantages and can be the best option for different types of students and families.

Paying once a year is the most common payment system for small schools, and is often the most cost-effective option. This payment system is ideal for students and families who have the ability to pay their tuition in full at the beginning of the year. It also allows families to avoid any late fees or interest charges, as tuition is paid in full at the start of the year. However, this option may be difficult for families who struggle to pay large sums of money upfront.

Paying once a semester is an appealing option for families who don’t want to pay the entire tuition upfront. This payment system allows families to pay half the tuition at the beginning of the year, and the other half at the start of the second semester. This can be a great option for families who are capable of making two payments throughout the year, but may not be able to pay the full amount up front.

Finally, paying once a month is the most flexible payment system for small schools. This payment system allows families to spread their tuition payments out over the course of the year, making it much easier for them to pay their tuition. This is a great option for families who need the flexibility to make smaller payments each month, as opposed to large payments at the beginning of the year.

When deciding which tuition payment system is best for your small school, it’s important to consider each of these options and the advantages and disadvantages that come with them. Each payment system has its own benefits and drawbacks and can be the right choice for different families. Be sure to weigh these options carefully and make the best choice for your school and your students.

Use An Online Payment System

One of the main advantages of paying tuition online is the ability to set up automatic payments. This eliminates the need to remember due dates or manually transfer money each month. Instead, online payments are processed automatically on the same day each month, ensuring you never miss a payment. This can be especially helpful for busy students or parents who may not have the time to manually pay tuition each month.

Another benefit of paying tuition online is improved accuracy. When payments are made manually, there’s always the potential for errors, such as entering the wrong amount or forgetting to include payment. But when payments are processed electronically, you can rest assured that the correct information is being sent and the payment is being made on time. This can help you avoid any late fees or penalties that you may incur from errors.

Finally, paying tuition online means enhanced security. When you make an online payment, your information is encrypted and protected from potential hackers. This can provide peace of mind knowing that your personal and financial information is safe. Additionally, many online payment platforms offer fraud protection and reimbursements in the event of unauthorized transactions.

Overall, the ability to pay tuition online has revolutionized the way students and parents manage their college finances. Not only does it provide convenience and flexibility, but it also offers a multitude of benefits, such as setting up automatic payments to avoid missing a due date, improved accuracy, and enhanced security. With these advantages, it’s no wonder why more and more students and parents are opting to pay tuition online.

Keep Track of Payment History

When it comes to tuition, invoices, and notes can help you keep track of each semester’s tuition payments. Knowing when each payment was made and when the next one is due can help you stay on top of your payments and avoid any late fees or missed payments. The same goes for textbooks. Keeping track of when you bought a book and when you will need to buy a new one can help you stay on top of your budget and make sure you are not overspending on textbooks.

Activity fees can be tricky to keep track of, but invoices and notes can help you stay organized. Writing down when you paid for each activity or event can help you avoid any confusion or missed payments. This can also help you plan ahead for future payments and make sure you are not overspending on any particular activity.

Invoices and notes can also help you track other payments, such as rent, utilities, and other bills. Writing down when each payment is due and when it was paid can help you stay on top of these payments and avoid any late fees or missed payments.

Overall, invoices and notes are a great way to keep track of your payments. Having a record of what and when you paid for each item can help you stay on top of your budget and make sure you are not overspending on any particular item. It can also help you plan ahead and budget for future payments.

How SchoolCues Can Help You Pay for Small School Tuition

The SchoolCues tuition management tools help schools and parents keep track of tuition and other payments through its online payment module. Through SchoolCues, families can set up automatic payments and save their bank account information for fast and easy checkout. SchoolCues also includes student profiles so you only need to pay for what is due for your specific child rather than paying for it all at once. Finally, SchoolCues makes keeping track of payments easy with its own categorization tool and invoice system so that you always know what you paid for.